DEF 14A: Definitive proxy statements

Published on January 24, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

| Preliminary Proxy Statement |

||

|

|

|

|||

| ☐ |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||

|

|

|

|||

| ☒ |

| Definitive Proxy Statement |

||

|

|

|

|||

| ☐ |

| Definitive Additional Materials |

||

|

|

|

|||

| ☐ |

| Soliciting Material Pursuant to §240.14a-12 |

||

|

|

||||

| MIDWEST ENERGY EMISSIONS CORP. |

||||

| (Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

|

|

||||

| Payment of Filing Fee (Check the appropriate box): |

||||

|

|

|

|||

| ☒ |

| No fee required. |

||

|

|

|

|||

| ☐ |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

|

|

|

||

|

|

| (1) |

| Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

| Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (4) |

| Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (5) |

| Total fee paid: |

|

|

|

|

|

|

|

|

|

|

|

|

| ☐ |

| Fee paid previously with preliminary materials. |

||

|

|

|

|||

| ☐ |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

|

|

||

|

|

| (1) |

| Amount Previously Paid: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

| Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) |

| Filing Party: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (4) |

| Date Filed: |

|

|

|

|

|

|

MIDWEST ENERGY EMISSIONS CORP.

1810 Jester Drive

Corsicana, Texas 75109

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 24, 2022

To the Stockholders of Midwest Energy Emissions Corp.:

A special meeting of stockholders (the “Special Meeting”) of Midwest Energy Emissions Corp. (the “Company”) will be held exclusively online via the Internet on Thursday, February 24, 2022, at 10:00 a.m. Eastern Time. The purposes of the meeting are:

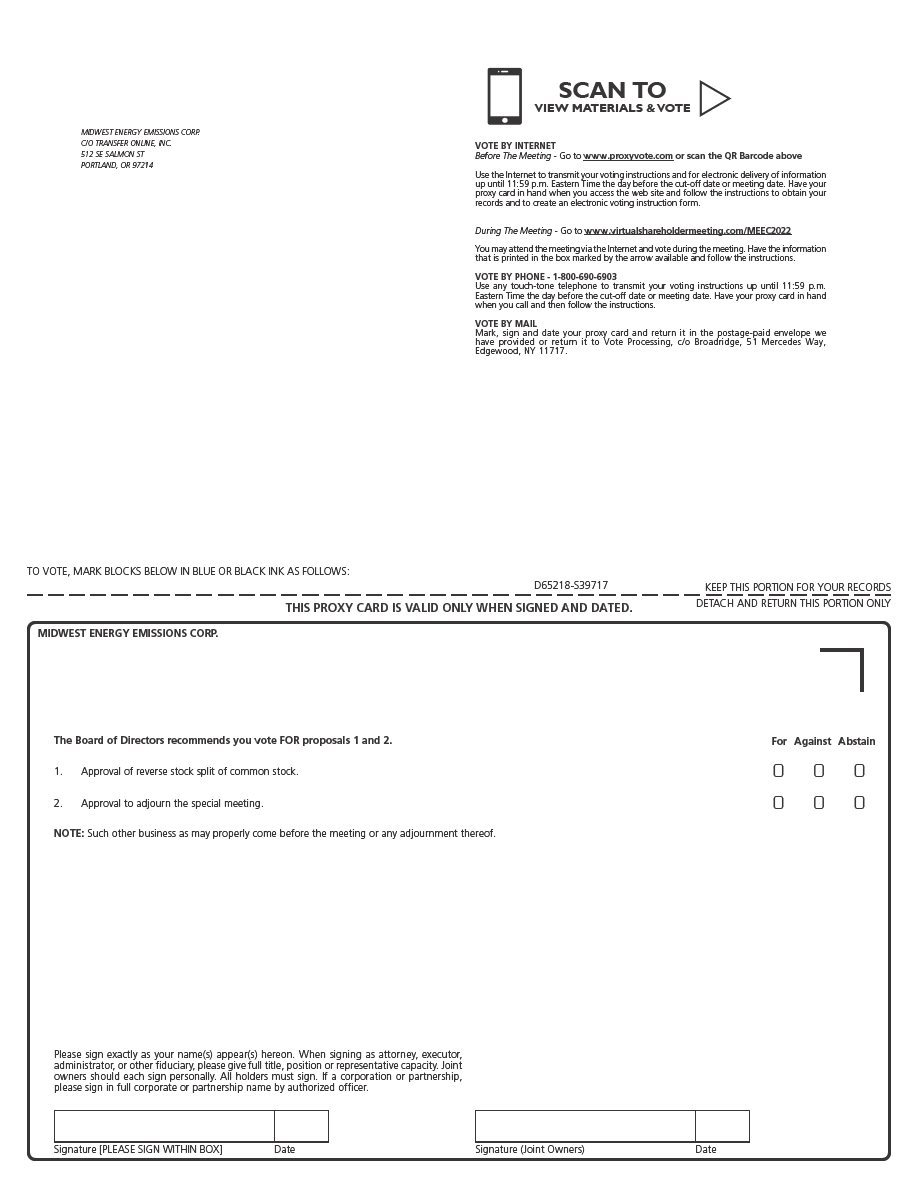

1. To approve a proposal to authorize our board of directors (the “Board”), in its sole and absolute discretion, and without further action of the stockholders, to file an amendment to our certificate of incorporation, as amended to the date of this proxy statement (the “Certificate of Incorporation”), to effect a reverse stock split of our issued and outstanding common stock, par value $0.001 per share, at a ratio to be determined by the Board, ranging from one-for-two to one-for-seven (the “Reverse Split”), with the Reverse Split to be effected at such time and date, if at all, as determined by the Board in its sole discretion, but no later than December 31, 2023, when the authority granted in this proposal to implement the Reverse Split would terminate (Proposal 1);

2. To approve an adjournment of the Special Meeting, if necessary and appropriate, as determined by the Board in its sole discretion, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Reverse Split or to constitute a quorum (Proposal 2); and

3. To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof.

Our board of directors has fixed the close of business on January 14, 2022 as the record date (the “Record Date”) for determining holders of our common stock entitled to notice of, and to vote at, the Special Meeting or any adjournments or postponements thereof.

The Special Meeting will be presented exclusively online at www.virtualshareholdermeeting.com/MEEC2022. You will be able to attend the Special Meeting online, vote your shares electronically, and submit your questions to management during the Special Meeting by visiting the aforementioned website.

You may also vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it in the envelope provided. In addition, you may vote by telephone: call toll-free 1-800-690-6903 and follow the instructions provided by the recorded message. You will need your proxy card available if you vote by telephone. You may also vote by Internet: access www.proxyvote.com and follow the steps outlined on the secure website.

Your vote is important. Whether or not you plan to attend the virtual Special Meeting, please vote in accordance with the instructions in the Notice or by completing, signing, dating, and returning your proxy card or voting instruction form so that your shares will be represented at the Special Meeting.

This Notice and Proxy Statement are dated January 24, 2022 and are first being mailed to shareholders on or about January 24, 2022. Please note that this Notice and Proxy Statement are also available at http://www.me2cenvironmental.com.

|

| By order of the Board of Directors, |

|

|

|

|

|

| Corsicana, Texas | David M. Kaye |

|

| Date: January 24, 2022 | Secretary |

|

| i |

MIDWEST ENERGY EMISSIONS CORP.

Proxy Statement

For a Special Meeting of Stockholders

To Be Held on February 24, 2022

| ii |

MIDWEST ENERGY EMISSIONS CORP.

1810 Jester Drive

Corsicana, Texas 75109

(614) 505-6115

PROXY STATEMENT FOR

SPECIAL MEETING OF STOCKHOLDERS

This Proxy Statement and associated proxy card are furnished in connection with the solicitation of proxies to be voted at a Special Meeting of Stockholders (the “Special Meeting”) of Midwest Energy Emissions Corp. (“we,” “us,” the “Company,” or “ME2C Environmental”), which will be held on Thursday, February 24, 2022, at 10:00 a.m. Eastern Time virtually via the Internet at www.virtualshareholdermeeting.com/MEEC2022.

By visiting this website, you may attend the Special Meeting virtually online, vote your shares electronically, and submit your questions to management during the Special Meeting. You may also vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it in the envelope provided. In addition, you may vote by telephone: call toll-free 1-800-690-6903 and follow the instructions provided by the recorded message. You will need your proxy card available if you vote by telephone. You may also vote by Internet: access www.proxyvote.com and follow the steps outlined on the secure website.

In addition to receiving printed copies, this Proxy Statement is also available to stockholders at http://www.me2cenvironmental.com.

Proposals to be Voted on at the Special Meeting

The following matters are scheduled to be voted on at the Special Meeting:

|

| · | Proposal 1: To approve a proposal to authorize the Board, in its sole and absolute discretion, and without further action of the stockholders, to file an amendment to our certificate of incorporation, as amended to the date of this proxy statement, to effect a reverse stock split of our issued and outstanding common stock at a ratio to be determined by the Board, ranging from one-for-two to one-for-seven, with such reverse stock split to be effected at such time and date, if at all, as determined by the Board in its sole discretion, but no later than December 31, 2023, when the authority granted in this proposal to implement the Reverse Split would terminate; and |

|

|

|

|

|

| · | Proposal 2: To approve an adjournment of the Special Meeting, if necessary and appropriate, as determined by the Board in its sole discretion, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Reverse Split or to constitute a quorum. |

No cumulative voting rights are authorized, and appraisal or dissenters’ rights are not applicable to these matters.

Questions and Answers about the Special Meeting

Please see “Questions and Answers about the Special Meeting” beginning on page 10 for important information about the proxy materials, voting, and the Special Meeting. If you have any questions, require any assistance with voting your shares, or need additional copies of this Proxy Statement or voting materials, please contact:

Stacey Hyatt

Corporate Communications

Midwest Energy Emissions Corp.

Main: 614-505-6115 x-1001

Direct: 404-226-4217

shyatt@me2cenvironmental.com

| 1 |

| Table of Contents |

MATTERS TO BE CONSIDERED AT THE SPECIAL MEETING

PROPOSAL 1: APPROVAL OF REVERSE STOCK SPLIT OF OUR COMMON STOCK

Pursuant to a proposal that was approved by our Company’s stockholders as Proposal 6 at the 2021 Annual Meeting of Stockholders on June 3, 2021 (the “Prior Approval”), the Board previously had the authority to complete a reverse stock split at a ratio to be determined by the Board ranging from one-for-two to one-for-seven, to be effected at such time and date, if at all, as determined by the Board in its sole discretion but no later than December 31, 2021.

Due to various factors, including but not limited to market conditions and the trading prices which existed for our common stock from June 2021 through December 2021, the Board determined not to complete such reverse stock split during 2021 and, as a result, the Prior Approval expired on December 31, 2021.

By this Proposal 1, the Board is requesting reapproval of its previously granted authority to complete a reverse stock split at a ratio ranging from one-for-two to one-for-seven, which is the same ratio range provided by the Prior Approval. Proposal 1 will provide the Board flexibility to complete such reverse stock split, if at all, on or before December 31, 2023.

The Board has unanimously adopted a resolution approving, declaring advisable, and recommending to the stockholders for their approval, a proposal to amend the Certificate of Incorporation to effect the Reverse Split of our common stock at any whole number ratio between, and inclusive of, one-for-two to one-for-seven. Approval of this Proposal 1 will grant the Board the authority, without further action by the stockholders, to implement an amendment to the Certificate of Incorporation to effect the Reverse Split (the “Amendment”) no later than December 31, 2023, with the exact exchange ratio and timing of the Reverse Split (if at all) to be determined at the discretion of the Board. The Board’s decision whether or not (and when) to effect the Reverse Split, and at what whole number ratio to effect the Reverse Split, will be based on a number of factors, including market conditions, existing and anticipated trading prices for our common stock, and the listing requirements of The Nasdaq Capital Market. If the Board does not implement the Reverse Split before December 31, 2023, the authority granted in this proposal to implement the Reverse Split would terminate. Further, if the stockholders do not approve this Proposal 1, the Board will not be authorized to effect the Reverse Split.

A sample form of the certificate of amendment relating to this Proposal 1, which we would file with the Secretary of State of the State of Delaware to implement the Reverse Split, is attached to this Proxy Statement as Appendix A.

The primary purpose for effecting the Reverse Split is to increase the per-share trading price of our common stock, particularly in light of our application to list our common stock on The Nasdaq Capital Market, so we can:

|

| · | meet the price criteria for listing on Nasdaq; |

|

|

|

|

|

| · | broaden the pool of investors that may be interested in investing in our Company by attracting new investors who would prefer not to invest, or cannot invest, in shares that trade at lower share prices; and |

|

|

|

|

|

| · | make our common stock a more attractive investment to institutional investors. |

In evaluating the Reverse Split, the Board has considered and will continue to consider negative factors associated with reverse stock splits. These factors include the negative perception of reverse stock splits held by many investors, analysts, and other stock market participants, including their awareness that the trading prices of the common stock of some companies that have effected reverse stock splits have subsequently declined to pre-reverse stock split levels. In recommending the Reverse Split, the Board determined that it believes the potential benefits of the Reverse Split significantly outweighed these potential negative factors.

| 2 |

| Table of Contents |

Potential Advantages of a Reverse Split

The Board is seeking authority to effect the Reverse Split with the primary intent of increasing the price of our common stock to meet the price criteria for listing on Nasdaq and making our common stock more attractive to a broader range of institutional and other investors. Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Split is in our and our stockholders’ best interests.

The Reverse Split could effectively increase the per-share trading price of our common stock to enable us to meet the price criteria for listing on Nasdaq. By listing our common stock on The Nasdaq Capital Market, we would have greater flexibility to consider and possibly pursue a wide range of future financing options. We believe being listed on a national securities exchange like The Nasdaq Capital Market is valued highly by many investors, particularly institutional investors. A listing on a national securities exchange also has the potential to create better liquidity and reduce volatility for buying and selling shares of our stock, which benefits our current and future stockholders.

In addition, the Board believes that an expected increased stock price could encourage investor interest and improve the marketability of our common stock to a broader range of investors, and thus enhance our liquidity. Because of the trading volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Additionally, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current share price of our common stock may result in an investor paying transaction costs that represent a higher percentage of total share value than would be the case if our share price were higher. The Board believes that the higher share price that may result from the Reverse Split could enable institutional investors and brokerage firms with such policies and practices to invest in our common stock.

Potential Risks from a Reverse Split

We cannot assure that the total market capitalization of our common stock after the implementation of the Reverse Split will be equal to or greater than the total market capitalization before the Reverse Split or that the per-share market price of our common stock following the Reverse Split will increase in proportion to the reduction in the number of shares of our common stock outstanding in connection with the Reverse Split. Also, we cannot assure you that the Reverse Split would lead to a sustained increase in the trading price of our common stock. The trading price of our common stock may change due to a variety of other factors, including our ability to successfully accomplish our business goals, market conditions, and the market perception of our business. You should also keep in mind that the implementation of the Reverse Split does not affect the actual or intrinsic value of our business or a stockholder’s proportional ownership in our Company (subject to the treatment of fractional shares). If the overall value of our common stock declines after the proposed Reverse Split, however, then the actual or intrinsic value of the shares of our common stock will also proportionately decrease as a result of the overall decline in value.

Further, the Reverse Split may reduce the liquidity of our common stock, given the reduced number of shares that would be outstanding after the Reverse Split, particularly if the expected increase in stock price as a result of the Reverse Split is not sustained. For instance, the proposed Reverse Split may increase the number of stockholders who own odd lots (fewer than 100 shares) of our common stock, creating the potential for those stockholders to experience an increase in the cost of selling their shares and greater difficulty in selling those shares. If we effect the Reverse Split, the resulting per-share stock price may nevertheless fail to attract institutional investors and may not satisfy the investing guidelines of such investors and, consequently, the trading liquidity of our common stock may not improve.

Although we expect the Reverse Split to result in an increase in the market price of our common stock, the Reverse Split may not result in a permanent increase in the market price of our common stock, which would depend on many factors, including general economic, market and industry conditions, and other factors described from time to time in the reports we file with the SEC.

| 3 |

| Table of Contents |

If our stockholders approve the Reverse Split and the Board elects to effect the Reverse Split, the number of outstanding shares of common stock will be reduced in proportion to the ratio of the split chosen by the Board (subject to the treatment of fractional shares), while the number of authorized shares of common stock will remain at 150,000,000. As of the effective time of the Reverse Split, we would also adjust and proportionately decrease the number of shares of our common stock reserved for issuance upon exercise of, and adjust and proportionately increase the exercise price of, all options and warrants and other rights to acquire our common stock. We would also proportionately reduce the number of shares that are issuable on vesting of outstanding restricted stock units, if any. In addition, as of the effective time of the Reverse Split, we would adjust and proportionately decrease the total number of shares of our common stock that may be the subject of the future grants under our stock plans.

The Reverse Split would be effected simultaneously for all outstanding shares of our common stock. The Reverse Split would affect all of our stockholders uniformly and would not change any stockholder’s percentage ownership interest in our Company, except to the extent that the Reverse Stock Split results in any of our stockholders owning fractional shares. We would not issue fractional shares in connection with the Reverse Split. Instead, any stockholders who own a number of shares not evenly divisible by the Reverse Split ratio would be entitled to the rounding up of their fractional share to the nearest whole share. The Reverse Split would not change the terms of our common stock. The Reverse Split is not intended as, and would not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

After the effective time of the Reverse Split, our common stock will have a new CUSIP number, which is a number used to identify our equity securities, and investors holding stock certificates with the older CUSIP number will need to exchange them for stock certificates with the new CUSIP numbers by following the procedures described below.

Our common stock is currently registered under Section 12(g) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The implementation of the Reverse Split will not affect the registration of our common stock under the Exchange Act, and following the Reverse Split, we would continue to be subject to the periodic reporting requirements of the Exchange Act. Our common stock would continue to be quoted on the OTCQB operated by OTC Markets Group Inc. under the symbol “MEEC” immediately following the Reverse Split.

Assuming Reverse Split ratios of 1-for-two, 1-for-four, and 1-for-seven, the following table sets forth (a) the number of shares of our common stock that would be issued and outstanding, (b) the number of shares of our common stock that would be reserved for issuance pursuant to outstanding options, warrants, and restricted stock units, and (c) the weighted-average exercise price of outstanding options and warrants, each giving effect to the Reverse Split and based on securities outstanding as of January 14, 2022, the record date (without giving effect to the treatment of fractional shares).

|

|

| Before Reverse Stock Split |

|

| Reverse Stock Split Ratio of 1-for-2 (1) |

|

| Reverse Stock Split Ratio of 1-for-4 (1) |

|

| Reverse Stock Split Ratio of 1-for-7 (1) |

|

||||

| Number of Shares of Common Stock Issued and Outstanding |

|

| 89,615,951 |

|

|

| 44,807,976 |

|

|

| 22,403,988 |

|

|

| 12,802,279 |

|

| Number of Shares of Common Stock Reserved for Issuance Pursuant to Outstanding Options, Warrants, and Restricted Stock Units |

|

| 22,603,326 |

|

|

| 11,301,663 |

|

|

| 5,650,832 |

|

|

| 3,229,047 |

|

| Weighted-Average Exercise Price of Outstanding Options and Warrants |

| $ | 0.56 |

|

| $ | 1.12 |

|

| $ | 2.24 |

|

| $ | 3.92 |

|

__________

| (1) | The actual number of shares of common stock outstanding after the Reverse Stock Split may be higher depending on the number of fractional shares that are rounded up. |

If the Board does not implement the Reverse Split before December 31, 2023, the authority granted in this proposal to implement the Reverse Split would terminate.

Our directors and executive officers have no substantial interests, directly or indirectly, in the Reverse Split, except to the extent of their ownership in shares of our common stock and securities convertible or exercisable for our common stock, which shares and securities would be subject to the same proportionate adjustment in accordance with the terms of the Reverse Split as all other outstanding shares of our common stock and securities convertible into or exercisable for our common stock.

| 4 |

| Table of Contents |

Authorized Shares of Common Stock

We are currently authorized under our Certificate of Incorporation to issue up to a total of 152,000,000 shares of capital stock, comprised of 150,000,000 shares of common stock and 2,000,000 shares of preferred stock. A total of 89,615,951 shares of common stock are outstanding. While the Reverse Split would decrease the number of outstanding shares of our common stock, it would not change the number of authorized shares under our Certificate of Incorporation. Consequently, the practical effect of the Reverse Split would be to substantially increase the number of shares of common stock available for issuance under our Certificate of Incorporation. The Board believes that such an increase is in our and our stockholders’ best interests because it would give us greater flexibility to issue shares of common stock in connection with possible future financings, joint ventures, and acquisitions as well as under our equity incentive plans and for other general corporate purposes. Although we do not currently have any plans, understandings, arrangements, commitments or agreements, written or oral, for the issuance of the additional shares of common stock that would become available for issuance if the Reverse Split is effected, we believe it would be advantageous in the future to have the shares available for the purposes described above in the future.

By increasing the number of authorized but unissued shares of common stock, the Reverse Split could, under certain circumstances, have an anti-takeover effect, although this is not the intent of the Board. For example, the Board might be able to delay or impede a takeover or transfer of control of our Company by causing such additional authorized but unissued shares to be issued to holders who might side with the Board in opposing a takeover bid that the Board determines, in the exercise of its fiduciary duties, is not in the best interests of our Company or our stockholders. The Reverse Split could therefore have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the Reverse Split could limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The Reverse Split could have the effect of providing the Board with additional means to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of our business, including making it more difficult for stockholders to remove directors. The Board is not aware of any attempt to take control of our Company and did not authorize the Reverse Split with the intention of using it as a type of anti-takeover device.

Procedure for Effecting the Reverse Split

If our stockholders approve the Reverse Split and if the Board concludes that the Reverse Split is in the best interests of our Company and our stockholders on a date no later than December 31, 2023, the Board would cause the Reverse Split to be implemented at a whole number ratio between one-for-two to one-for-seven, as selected by the Board in its sole discretion. We would file the Certificate of Amendment with the Secretary of State of Delaware so that it becomes effective at the time the Board determines to be appropriate. The Board may delay effecting the Amendment without resoliciting stockholder approval to any time before December 31, 2023 (if at all). The Amendment would become effective on the date the Certificate of Amendment is filed with the Secretary of State of Delaware or at such later effective date and time as specified in the Certificate of Amendment.

Record and Beneficial Stockholders

If the Reverse Split is implemented, all of our registered holders of common stock who hold their shares electronically in book-entry form with our transfer agent, Transfer Online, Inc. (“TO”), will receive a statement from TO reflecting the number of shares of our common stock registered in their accounts. No action needs to be taken to receive post-Reverse Split shares because the exchange will be automatic. Stockholders holding certificated shares (i.e., shares represented by one or more physical stock certificates) will be requested to exchange their old stock certificate or certificates (“Old Certificates”) for shares held in book-entry form through the Depository Trust Company’s Direct Registration System representing the appropriate number of whole shares of our common stock resulting from the Reverse Split. TO will furnish to stockholders of record upon the effective time of the Reverse Split the necessary materials and instructions for the surrender and exchange of their Old Certificates at the appropriate time. Stockholders will not have to pay any transfer fee or other fee in connection with such exchange. As soon as practicable after the effective time of the Reverse Split, TO will send a transmittal letter to each stockholder advising such holder of the procedure for surrendering Old Certificates in exchange for new shares held in book-entry form. You would not be able to use your Old Certificates representing pre-split shares for either transfers or deliveries. Accordingly, you must exchange your Old Certificates to effect transfers or deliveries of your shares.

| 5 |

| Table of Contents |

Non-registered stockholders holding common stock through a bank, broker, or other nominee should note that such banks, brokers, or other nominees may have different procedures for processing the Reverse Split than those that we would put in place for registered stockholders. If you hold your shares with such a bank, broker, or other nominee and if you have questions in this regard, you are encouraged to contact your nominee.

No fractional shares would be issued in connection with the Reverse Split. Stockholders of record who otherwise would be entitled to receive fractional shares would be entitled to rounding up of their fractional share to the nearest whole share.

Effect on Options, Warrants, Preferred Stock, and Other Securities

All outstanding options, warrants, preferred stock, and other securities entitling their holders to purchase shares of our common stock, if any, would be adjusted as a result of the Reverse Split, as required by the terms of each security. In particular, the conversion ratio for each security would be reduced proportionately, and the exercise price, if applicable, would be increased proportionately, in accordance with the terms of each security and based on the exchange ratio implemented in the Reverse Split. We would also proportionately reduce the number of shares that are issuable on vesting of outstanding restricted stock units, if any.

The Reverse Split would not affect the par value of our common stock per share, which would continue to be $0.001 par value per share, while the number of outstanding shares of common stock would decrease in accordance with the Reverse Split ratio. As a result, as of the effective time of the Reverse Split, the stated capital attributable to common stock on our balance sheet would decrease and the additional paid-in capital account on our balance sheet would increase by an offsetting amount. Following the Reverse Split, reported per share net income or loss would be higher because there would be fewer shares of common stock outstanding, and we would adjust historical per share amounts in our future financial statements.

Discretionary Authority of the Board to Abandon Reverse Split

The Board reserves the right to abandon the Amendment without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of State of Delaware of the Certificate of Amendment, even if our stockholders have authorized the Reverse Split at the Special Meeting. By voting in favor of the Reverse Split, you are expressly also authorizing the Board to determine not to proceed with, and abandon, the Reverse Split, if the Board should so decide.

No Appraisal or Dissenters’ Rights

Neither Delaware law, the Certificate of Incorporation, nor our amended and restated by-laws provide for appraisal or other similar rights for dissenting stockholders in connection with this proposal. Accordingly, our stockholders will have no right to dissent and obtain payment for their shares, and we will not independently provide stockholders with any such right.

Material U.S. Federal Income Tax Consequences of the Reverse Split

The following discussion is a summary of the material U.S. federal income tax consequences of the proposed Reverse Split to U.S. Holders (as defined below) of our common stock. This discussion is based on the Code, U.S. Treasury Regulations promulgated under the Code, judicial decisions and published rulings and administrative pronouncements of the U.S. Internal Revenue Service (the “IRS”), in each case in effect as of the date of this Proxy Statement. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a U.S. Holder. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below. There can be no assurance that the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the proposed Reverse Split.

| 6 |

| Table of Contents |

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of our common stock who or that, for U.S. federal income tax purposes, is or is treated as:

|

| · | an individual who is a citizen or resident of the United States; |

|

|

|

|

|

| · | a corporation (or any other entity or arrangement treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of the United States, any state thereof, or the District of Columbia; |

|

|

|

|

|

| · | an estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

|

|

|

|

|

| · | a trust if (1) its administration is subject to the primary supervision of a court within the United States and all of its substantial decisions are subject to the control of one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code), or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a United States person. |

This discussion is limited to U.S. Holders who hold our common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to the particular circumstances of a U.S. Holder, including the effect of the Medicare contribution tax on net investment income. In addition, it does not address consequences relevant to U.S. Holders that are subject to special rules, including, without limitation:

|

| · | Financial institutions; |

|

|

|

|

|

| · | Insurance companies; |

|

|

|

|

|

| · | Real estate investment trusts; |

|

|

|

|

|

| · | Regulated investment companies; |

|

|

|

|

|

| · | Grantor trusts; |

|

|

|

|

|

| · | Tax-exempt organizations; |

|

|

|

|

|

| · | Dealers or traders in securities or currencies; |

|

|

|

|

|

| · | U.S. Holders who hold common stock as part of a position in a straddle or as part of a hedging, conversion or integrated transaction for U.S. federal income tax purposes or U.S. holders that have a functional currency other than the U.S. dollar; or |

|

|

|

|

|

| · | U.S. Holders who actually or constructively own 10% or more of our voting stock. |

If a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Accordingly, partnerships (and other entities treated as partnerships for U.S. federal income tax purposes) holding our common stock and the partners in such entities should consult their own tax advisors regarding the U.S. federal income tax consequences of the proposed Reverse Split to them.

In addition, the following discussion does not address the U.S. federal estate and gift tax, alternative minimum tax, or state, local, and non-U.S. tax law consequences of the proposed Reverse Split. Furthermore, the following discussion does not address any tax consequences of transactions effectuated before, after or at the same time as the proposed Reverse Split, whether or not they are in connection with the proposed Reverse Split. This discussion should not be considered as tax or investment advice, and the tax consequences of the proposed Reverse Split may not be the same for all stockholders.

The proposed Reverse Stock Split is intended to be treated as a “recapitalization” for U.S. federal income tax purposes pursuant to Section 368(a)(1)(E) of the Code. As a result, a U.S. Holder generally should not recognize gain or loss upon the proposed Reverse Stock Split for U.S. federal income tax purposes. A U.S. Holder’s aggregate adjusted tax basis in the shares of our common stock received pursuant to the proposed Reverse Stock Split should equal the aggregate adjusted tax basis of the shares of our common stock surrendered (reduced by the amount of such basis that is allocated to any fractional share of our common stock). The U.S. Holder’s holding period in the shares of our common stock received should include the holding period in the shares of our common stock surrendered. U.S. Holders of shares of our common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

| 7 |

| Table of Contents |

Backup withholding is not an additional tax and amounts withheld will be allowed as a credit against the holder’s U.S. federal income tax liability and may entitle such holder to a refund, provided the required information is timely furnished to the IRS. Holders of our common stock should consult their own tax advisors regarding the application of the information reporting and backup withholding rules to them.

This discussion is for general information only and is not tax advice. It does not discuss all aspects of U.S. federal taxation that may be relevant to a particular stockholder in light of such stockholder’s circumstances and income tax situation. Accordingly, stockholders should consult their tax advisors with respect to the application of the U.S. federal income tax laws to their particular situations as well as any tax consequences of the proposed reverse stock split arising under the U.S. federal estate or gift tax laws or under the laws of any state, local, or non-U.S. taxing jurisdiction or under any applicable income tax treaty.

For Proposal 1 to be approved, holders of a majority of all outstanding shares must vote FOR Proposal 1. Abstentions and broker non-votes (if any) will essentially be no votes.

The Board unanimously recommends that you vote FOR the approval of the Reverse Stock Split.

PROPOSAL 2: APPROVAL TO ADJOURN THE SPECIAL MEETING

Proposal 2 will be presented to stockholders at the Special Meeting to seek their approval of an adjournment to another time or place, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve the Reverse Split or to constitute a quorum.

If, at the Special Meeting, the number of shares present or represented and voting to approve the Reverse Split is not sufficient to approve that proposal, or if a quorum is not present, the Board currently intends to move to adjourn the Special Meeting to enable the Board to solicit additional proxies for the approval of the Reverse Split.

In this proposal, we are asking our stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of granting discretionary authority to the Board to adjourn the Special Meeting to another time and place for the purpose of soliciting additional proxies. If the stockholders approve Proposal 2, the Board could adjourn the Special Meeting and any adjourned session of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders who have previously voted.

For Proposal 2 to be approved, holders of a majority of all those outstanding shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Special Meeting must vote FOR Proposal 2. Abstentions and broker non-votes will not be counted either FOR or AGAINST the proposal and will have no effect on the proposal.

The Board unanimously recommends that you vote

FOR the approval of the adjournment of the Special Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to us regarding beneficial ownership of our common stock as of the record date by:

|

| · | each person or group of affiliated persons known by us to be the beneficial owner of more than five percent of our capital stock; |

|

|

|

|

|

| · | each of our named executive officers; |

|

|

|

|

|

| · | each of our directors; and |

|

|

|

|

|

| · | all of our executive officers and directors as a group. |

The column entitled “Percentage of Shares Beneficially Owned” is calculated based on 89,615,951 shares of common stock outstanding as of January 14, 2022.

| 8 |

| Table of Contents |

We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities as well as any shares of common stock that the person has the right to acquire within 60 days of January 14, 2022 through the exercise of stock options or other rights. These shares are deemed to be outstanding and beneficially owned by the person holding those options for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them.

Except as otherwise noted below, the address for persons listed in the table is c/o the Company at 1810 Jester Drive, Corsicana, Texas 75109.

| Name of Beneficial Owner |

| Number of Shares Beneficially Owned |

|

| Percentage of Shares Beneficially Owned (7) |

|

||

|

|

|

|

|

|

|

|

||

| Richard MacPherson |

|

| 13,271,345 | (1) |

|

| 14.1 | % |

| Christopher Greenberg |

|

| 5,870,533 | (2) |

|

| 6.4 | % |

| John Pavlish |

|

| 6,339,070 | (3) |

|

| 6.7 | % |

| James Trettel |

|

| 3,730,685 | (4) |

|

| 4.0 | % |

| David M. Kaye |

|

| 675,000 | (5) |

| * |

|

|

| Alterna Core Capital Assets Fund II, L.P., et al |

|

| 11,700,000 | (6) |

|

| 13.1 | % |

| All current directors and executive officers as a group (6 persons) |

|

| 30,392,048 |

|

|

| 28.7 | % |

______________

| * | Less than one percent of the outstanding shares of common stock of the Company.

|

| (1) | Includes 8,680,826 shares owned by Mr. MacPherson and 4,590,510 shares which Mr. MacPherson has the right to acquire upon exercise of options.

|

| (2) | Includes 4,195,869 shares owned by Mr. Greenberg, 5,000 shares owned by Mr. Greenberg with his wife, 3,000 shares owned by Mr. Greenberg’s wife, and 1,666,664 shares which Mr. Greenberg has the right to acquire upon exercise of options.

|

| (3) | Includes 1,035,945 shares owned by Mr. Pavlish and 5,303,125 shares which Mr. Pavlish has the right to acquire upon exercise of options.

|

| (4) | Includes 136,935 shares owned by Mr. Trettel, 200,000 owned by Mr. Trettel’s wife, and 3,393,750 shares which Mr. Trettel has the right to acquire upon exercise of options within the next 60 days.

|

| (5) | Includes 675,000 shares which Mr. Kaye has the right to acquire upon exercise of options within the next 60 days.

|

| (6) | Represents 11,700,000 shares owned and based solely upon and according to information reported in filings made to the SEC, jointly filed by and on behalf of certain reporting persons identified below (the “Reporting Persons”). The Reporting Persons are Alterna Core Capital Assets Fund II, L.P., Alterna Capital Partners LLC, Alterna General Partner II LLC, AC Midwest Energy LLC, Harry V. Toll, Eric M. Press, Roger P. Miller, and Earle Goldin. The address for the Reporting Persons is 15 River Road, Suite 230, Wilton CT 06897.

|

| (7) | Applicable percentage ownership for each stockholder is based on 89,615,951 shares of common stock outstanding as of January 14, 2022 plus any securities that stockholder has the right to acquire within 60 days of January 14, 2022 pursuant to options, warrants, conversion privileges, or other rights. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants, or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of January 14, 2022 are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| 9 |

| Table of Contents |

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Why am I receiving these proxy materials?

You received these proxy materials because you owned shares of ME2C Environmental common stock as of January 14, 2022, the record date for the Special Meeting, and our Board is soliciting your proxy to vote at the Special Meeting. This Proxy Statement describes matters on which we would like you to vote at the Special Meeting. It also gives you information on these matters so that you can make an informed decision.

How do I attend the Special Meeting online?

We will host the Special Meeting exclusively live online. Any stockholder can attend the Special Meeting live online at www.virtualshareholdermeeting.com/MEEC2022. To enter the Special Meeting, you will need the password included in your Notice or your proxy card. Additional instructions on how to attend and participate online are posted at www.virtualshareholdermeeting.com/MEEC2022.

Who is entitled to vote at the Special Meeting?

Only stockholders of record at the close of business on the record date will be entitled to vote at the Special Meeting. On the record date, 89,615,951 shares of our common stock were outstanding. All of these outstanding shares are entitled to vote at the Special Meeting on the matters described in this Proxy Statement. Each share of common stock is entitled to one vote.

In accordance with Delaware law, a list of stockholders entitled to vote at the Special Meeting will be accessible for 10 days before the meeting at our principal place of business, 1810 Jester Drive, Corsicana, Texas 75109, between the hours of 9:00 a.m. and 5:00 p.m. local time. In addition, during the Special Meeting that list of stockholders will be available for examination at www.virtualshareholdermeeting.com/MEEC2022.

How do I vote at the Special Meeting?

If on the record date your shares were registered directly in your name with our transfer agent, Transfer Online, Inc., then you are a stockholder of record. Stockholders of record may vote by mail, by using the Internet, or by telephone, as described below. Stockholders of record also may attend the Special Meeting virtually and vote during the Special Meeting.

|

| · | You may vote by mail. If you choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope. Your proxy card must be received by the close of business on February 23, 2022. |

|

|

|

|

|

| · | You may vote by using the Internet. The address of the website for Internet voting is www.proxyvote.com. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on February 23, 2022, the day before the Special Meeting. Easy-to-follow instructions allow you to vote your shares and confirm that your instructions have been properly recorded. You may also vote by using the Internet during the Special Meeting. |

|

|

|

|

|

| · | You may vote by telephone. The toll-free telephone number is 1-800-690-6903. Telephone voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on February 23, 2022. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. |

| 10 |

| Table of Contents |

When you vote by any of the above methods, you appoint Richard MacPherson, our President and Chief Executive Officer, and Christopher Greenberg, our Chairman of the Board, as your representatives (or proxyholders) at the Special Meeting. By doing so, you ensure that your shares will be voted whether or not you attend the Special Meeting. The proxyholders will vote your shares at the Special Meeting as you have instructed them.

In addition, the proxyholders, in their discretion, are further authorized to vote on other matters that may properly come before the Special Meeting and any adjournments or postponements thereof.

If you hold shares through a bank or broker (i.e., in “street name”), please refer to your proxy card, Notice, or other information forwarded by your bank or broker to see which voting options are available to you.

The method you use to vote will not limit your right to vote at the Special Meeting if you decide to attend. If you desire to vote at the Special Meeting and hold your shares in “street name,” however, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote virtually at the Special Meeting.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are the stockholder of record of your shares, you may revoke your proxy in any one of three ways:

|

| · | You may submit a subsequent proxy by mail with a later date, by using the Internet, or by telephone; |

|

|

|

|

|

| · | You may deliver a written notice that you are revoking your proxy to the Secretary of ME2C Environmental at 1810 Jester Drive, Corsicana, Texas 75109; or |

|

|

|

|

|

| · | You may attend the Special Meeting virtually and vote your shares at the Special Meeting. Simply attending the Special Meeting without affirmatively voting will not, by itself, revoke your proxy. |

If you are a beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions for changing your vote.

How many votes do you need to hold the Special Meeting?

Under our bylaws, a quorum will be present if the holders of a majority of the voting power of the outstanding shares of the Company entitled to vote generally in the election of directors is represented in person or by proxy at the Special Meeting. Under Delaware law, if the board of directors of a company so authorizes, stockholders and proxyholders not physically present at a meeting of stockholders may, by means of remote communication, be deemed present in person at a stockholders meeting. The Board has so authorized. On the record date, there were 89,615,951 shares of common stock outstanding and entitled to vote. Therefore, for us to have a quorum, shares entitled to 44,807,976 votes must be represented by stockholders present at the Special Meeting or represented by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend the Special Meeting virtually and vote at that time. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present for the transaction of business. If a quorum is not present, the stockholders entitled to vote at the meeting, present or represented, will have the power to adjourn the meeting from time to time until a quorum shall be present or represented.

| 11 |

| Table of Contents |

What matters will be voted on at the Special Meeting?

The following matters are scheduled to be voted on at the Special Meeting:

|

| · | Proposal 1: To approve a proposal to authorize the Board, in its sole and absolute discretion, and without further action of the stockholders, to file an amendment to our certificate of incorporation, as amended to the date of this proxy statement, to effect a reverse stock split of our issued and outstanding common stock at a ratio to be determined by the Board, ranging from one-for-two to one-for-seven, with such reverse stock split to be effected at such time and date, if at all, as determined by the Board in its sole discretion, but no later than December 31, 2023, when the authority granted in this proposal to implement the Reverse Split would terminate; and |

|

|

|

|

|

| · | Proposal 2: To approve an adjournment of the Special Meeting, if necessary and appropriate, as determined by the Board in its sole discretion, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Reverse Split or to constitute a quorum. |

No cumulative voting rights are authorized, and appraisal or dissenters’ rights are not applicable to these matters.

What will happen if I do not vote my shares?

Stockholder of Record: Shares Registered in Your Name. If you are the stockholder of record of your shares and you do not vote by proxy card, by telephone, via the Internet, or virtually at the Special Meeting, your shares will not be voted at the Special Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank. Brokers, banks, or other nominees who hold shares of our common stock or preferred stock for a beneficial owner in “street name” have the discretion to vote on “routine” proposals when they have not received voting instructions from the beneficial owner at least 10 days prior to the Special Meeting. A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Under the rules that govern brokers that are voting shares held in street name, brokers have the discretion to vote those shares on routine matters but not on non-routine matters. Proposals 1 and 2 are matters we believe will be considered routine and, therefore, brokers will have discretionary authority to vote on all proposals and there will not be any broker non-votes. Brokers do not always exercise this discretionary authority, and if your broker does not (and you have not given any voting direction), your shares will not be voted. We strongly encourage you to submit your voting instructions to your broker to ensure your shares of common stock are voted in accordance with your instructions at the Special Meeting.

How may I vote for each proposal and what is the vote required for each proposal?

Proposal 1: Approval of the reverse stock split of our common stock.

You may vote FOR or AGAINST or ABSTAIN from voting on Proposal 1. For this proposal to be approved, we must receive a FOR vote from the holders of a majority of all outstanding shares. Abstentions and broker non-votes (if any) will essentially be no votes.

Proposal 2: Approval of the adjournment of the Special Meeting.

You may vote FOR or AGAINST or ABSTAIN from voting on Proposal 2. For this proposal to be approved, we must receive a FOR vote from the holders of a majority of all those outstanding shares that (a) are present or represented by proxy at the Special Meeting, and (b) are cast either affirmatively or negatively on the Proposal. Abstentions and broker non-votes (if any) will not be counted FOR or AGAINST the proposal and will have no effect on the proposal.

How does the Board recommend that I vote?

The Board recommends that you vote FOR Proposals 1 and 2.

What happens if I sign and return my proxy card but do not provide voting instructions?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted:

|

| · | Proposal 1: FOR the approval of the reverse stock split of our common stock; and |

|

|

|

|

|

| · | Proposal 2: FOR the approval of the adjournment of the Special Meeting. |

| 12 |

| Table of Contents |

Could other matters be decided at the Special Meeting?

We do not know of any other matters that may be presented for action at the Special Meeting. The proxyholders, in their discretion, are further authorized to vote on other matters that may properly come before the Special Meeting and any adjournments or postponements thereof.

How do I attend the virtual Special Meeting?

We are hosting the Special Meeting exclusively online at www.virtualshareholdermeeting.com/MEEC2022. The Notice includes instructions on how to participate in the Special Meeting and how to vote your shares of our capital stock by attending the virtual Special Meeting via the Internet. You will need to enter you will need the password included in your Notice or your proxy card to enter the Special Meeting via the online web portal. By visiting this website, you may attend the Special Meeting virtually online, vote your shares electronically, and submit your questions to management during the Special Meeting.

Who is paying for this proxy solicitation?

The accompanying proxy is being solicited by the Board. In addition to this solicitation, our officers, directors, and employees may solicit proxies in person, by telephone, or by other means of communication. Officers, directors, and employees will not be paid any additional compensation for soliciting proxies. In addition, we may also retain one or more third parties to aid in the solicitation of brokers, banks, and institutional and other stockholders. We will pay for the entire cost of soliciting proxies. We may reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

What happens if the Special Meeting is postponed or adjourned?

Unless the polls have closed or you have revoked your proxy, your proxy will still be in effect and may be voted once the Special Meeting is reconvened. However, you will still be able to change or revoke your proxy with respect to any proposal until the polls have closed for voting on that proposal.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results are expected to be announced at the Special Meeting. Final voting results will be reported on a Current Report on Form 8-K filed with the SEC no later than four business days following the conclusion of the Special Meeting.

How can I find ME2C Environmental’s proxy materials on the Internet?

This Proxy Statement is available at our corporate website at http://www.me2cenvironmental.com. You also can obtain copies without charge at the SEC’s website at www.sec.gov. Additionally, in accordance with SEC rules, you may access these materials at www.proxyvote.com, which does not have “cookies” that identify visitors to the site.

How do I obtain a separate set of ME2C Environmental’s proxy materials if I share an address with other stockholders?

In some cases, stockholders holding their shares in a brokerage or bank account who share the same surname and address and have not given contrary instructions receive only one copy of the Notice and Proxy Statement. This practice is designed to reduce duplicate mailings and save printing and postage costs as well as natural resources. If you would like to have a separate copy of the Notice and the Proxy Statement mailed to you or to receive separate copies of future mailings, please submit your request to the address or phone number that appears on your Notice or proxy card. We will deliver such additional copies promptly upon receipt of such request.

In other cases, stockholders receiving multiple copies of the Notice and Proxy Statement at the same address may wish to receive only one. If you would like to receive only one copy if you now receive more than one, please submit your request to the address or phone number that appears on your Notice or proxy card.

| 13 |

| Table of Contents |

Can I receive future proxy materials and annual reports electronically?

Yes. This Proxy Statement is available on our investor relations website located at http://www.me2cenvironmental.com. Instead of receiving paper copies in the mail, stockholders can elect to receive an email that provides a link to our future proxy materials and annual reports on the Internet. Opting to receive your proxy materials electronically will save us the cost of producing and mailing documents to your home or business, will reduce the environmental impact of our Special Meetings and will give you an automatic link to the proxy voting site.

STOCKHOLDER PROPOSALS AND NOMINATIONS

As previously stated in our proxy statement filed with the SEC on April 30, 2021 in connection with the 2021 annual meeting of stockholders, stockholder proposals submitted pursuant to Rule 14a-8 of the Exchange Act must have been received by the Secretary of the Company no later than the close of business on December 31, 2021 and otherwise comply with the requirements of Delaware law, Rule 14a-8 of the Exchange Act and our by-laws, in order to be considered for inclusion in our proxy statement for the 2022 annual meeting of stockholders. If we change the date of the 2022 annual meeting of stockholders by more than 30 days from the anniversary of the 2021 annual meeting of stockholders, stockholder proposals must be received a reasonable time before we begin to print and mail our proxy materials for the 2022 annual meeting of stockholders.

Stockholders who wish to (a) nominate persons for election to the Board at the 2022 annual meeting of stockholders or (b) present a proposal at the 2022 annual meeting of stockholders, but who do not intend for such proposal to be included in our proxy materials for such meeting, must deliver written notice of the nomination or proposal to Midwest Energy Emissions Corp., 1810 Jester Drive, Corsicana, Texas 75109, Attention: Secretary, no earlier than December 31, 2021 and no later than March 16, 2022. However, if the 2022 annual meeting of stockholders is held earlier than May 4, 2022 or later than July 3, 2022, nominations and proposals must be received no later than the close of business on the later of (a) the 60th day prior to the 2022 annual meeting of stockholders and (b) the 10th day following the day we first publicly announce the date of the 2022 annual meeting. The stockholder’s written notice must include certain information concerning the stockholder and each nominee and proposal, as specified in the bylaws.

This Proxy Statement is available at our corporate website at http://www.me2cenvironmental.com. You also can obtain copies without charge at the SEC’s website at www.sec.gov. Additionally, in accordance with SEC rules, you may access these materials at www.proxyvote.com, which does not have “cookies” that identify visitors to the site.

In our filings with the SEC, information is sometimes “incorporated by reference.” This means that we are referring you to information that has previously been filed with the SEC and the information should be considered as part of the particular filing. In addition, this Proxy Statement includes several website addresses. These website addresses are intended to provide inactive, textual references only. The information on these websites is not part of this Proxy Statement.

CONTACT FOR QUESTIONS AND ASSISTANCE WITH VOTING

If you have any questions or require any assistance with voting your shares or need additional copies of this Proxy Statement or voting materials, please contact:

Stacey Hyatt

Corporate Communications

Midwest Energy Emissions Corp.

Main: 614-505-6115 x-1001

Direct: 404-226-4217

shyatt@me2cenvironmental.com

| 14 |

| Table of Contents |

It is important that your shares are represented at the Special Meeting. Whether or not you plan to attend the Special Meeting, please vote by mail, by signing and returning the enclosed proxy card, by using the Internet, or by telephone, so your shares will be represented at the Special Meeting.

The form of proxy card and this Proxy Statement have been approved by the Board and are being mailed or delivered to stockholders by its authority.

The Board of Directors of Midwest Energy Emissions Corp.

Corsicana, Texas

January 24, 2022

| 15 |

| Table of Contents |

CERTIFICATE OF AMENDMENT

TO THE

CERTIFICATE OF INCORPORATION

OF

MIDWEST ENERGY EMISSIONS CORP.

Midwest Energy Emissions Corp. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “General Corporation Law”), DOES HEREBY CERTIFY:

First: The name of the Corporation is Midwest Energy Emissions Corp.

Second: The date on which the Certificate of Incorporation of the Corporation was originally filed with the Secretary of State of the State of Delaware is May 30, 2006, under the name of Digicorp, Inc.

Third: That Article IV of the Certificate of Incorporation of the Corporation, as amended (the “Certificate of Incorporation”), is hereby amended by deleting the first paragraph of Article IV in its entirety and inserting the following in lieu thereof:

The Corporation is authorized to issue two classes of stock to be designated common stock (“Common Stock”) and preferred stock (“Preferred Stock”). The number of shares of Common Stock authorized to be issued is one hundred fifty million (150,000,000), par value $0.001 per share, and the number of shares of Preferred Stock authorized to be issued is two million (2,000,000), par value $0.001 per share. Effective upon this Certificate of Amendment to the Certificate of Incorporation becoming effective pursuant to the General Corporation Law (the “Effective Time”), the shares of Common Stock issued and outstanding or held in treasury immediately prior to the Effective Time (the “pre-Reverse Split Common Stock”) shall be reclassified into a different number of shares of Common Stock (the “post-Reverse Split Common Stock”) such that each [ ( )] shares of pre-Reverse Split Common Stock shall, at the Effective Time, be automatically reclassified into one share of post-Reverse Split Common Stock (such reclassification and combination of shares, the “Reverse Split”). The par value of the Common Stock following the Reverse Split shall remain at $0.001 per share. No fractional shares of Common Stock shall be issued as a result of such reclassification and combination, rather stockholders who otherwise would be entitled to receive fractional share interests of Common Stock as a result of the reclassification and combination shall be entitled to receive in lieu of such fractional share interests, upon the Effective Time, one whole share of Common Stock in lieu of such fractional share interests. Each stock certificate that, immediately prior to the Effective Time, represented shares of pre-Reverse Split Common Stock shall, from and after the Effective Time, automatically and without any action on the part of the Corporation or the respective holders thereof, represent that number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common Stock represented by such certificate shall have been combined. Each holder of record of a certificate that represented shares of pre-Reverse Split Common Stock shall be entitled to receive, upon surrender of such certificate, a new certificate representing the number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common Stock represented by such certificate shall have been combined pursuant to the Reverse Split, provided that the Corporation may request such stockholder to exchange such stockholder’s certificate or certificates that represented shares of pre-Reverse Split Common Stock for shares held in book-entry form through the Depository Trust Company’s Direct Registration System representing the appropriate number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common Stock represented by such certificate or certificates shall have been combined.

| A-1 |

| Table of Contents |

Appendix A

Fourth: The foregoing amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

Fifth: That this Certificate of Amendment to the Certificate of Incorporation shall be effective as of 10:00 a.m. New York City time on the __ day of _________, 202_.

IN WITNESS WHEREOF, this Corporation has caused this Certificate of Amendment to Certificate of Incorporation to be signed by its President and Chief Executive Officer this ____ day of ___________ 202_.

MIDWEST ENERGY EMISSIONS CORP.

By:_______________________________

Richard MacPherson

President and Chief Executive Officer

| A-2 |